What is Key Person Insurance?

January 2024 Newsletter | By: Ian Sachs, CFP®, CLU®, ChFC®

View on LinkedIn

The new year is an opportunity for business owners to reevaluate both critical opportunities and risks within their businesses.

For over 40 years, Risk Resource has been a trusted provider of life insurance solutions for business and estate planning. More specifically, we provide succession planning guidance to several hundred business owners at any given time and to start off the new year, we wanted to discuss key person insurance – a topic that is vital to every growing business.

Why should your business carry key person insurance?

Key person insurance (also known as key man insurance) is a specialized form of life insurance that a company purchases to protect itself from the financial fallout that results from the death of a crucial employee, often an executive, with unique skills and knowledge. The policy provides a payout to the company in the event of the key person’s death, helping the business cover various costs such as hiring and training a replacement, settling outstanding debts, and ensuring a smooth transition in the wake of such a loss.

Many businesses rely on the expertise and contributions of key individuals to maintain their operations and profitability. Losing such a person can lead to severe disruptions, financial instability, and potentially business closure. Key person insurance provides a safety net, ensuring that the business can continue to function and thrive in the absence of a valuable employee.

Key Employee Examples

- Tough-to-replace experts (specialists, engineers, scientists, etc.)

- Influential and high-producing salespeople

- Executives and top management

How it Works

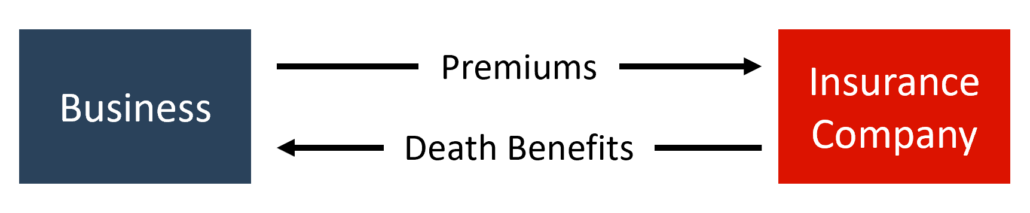

- The business purchases life insurance on the key employee(s)

- The business pays the premiums and is the owner and beneficiary

- Upon the key person’s death, the benefit is paid directly to the business

How is the amount of coverage justified for a key person?

To determine the right death benefit amount for key person insurance, Risk Resource helps to assess the specific financial loss that would occur. We provide a careful evaluation to help our clients implement the right plan that best suits their unique needs and circumstances, ultimately safeguarding their stability and longevity in the face of unforeseen challenges.

Sometimes it can take a little preparation to help an insurance carrier see the worth of a key person. By understanding what carriers are looking for, and why, it’s possible to justify larger key person policies.

For a typical business, which has been in operation many years, acquiring business owned life insurance on a key employee is relatively easy. The industry standard for determining maximum coverage is up to 10-15 times the employee’s income. If the desired face amount is within that limit, the insurance company’s requirement for financial justification is often simple.

On the other hand, there are less typical key person cases which present a greater challenge. These are cases requesting a face amount higher than the standard limit which raises the stakes for the carrier underwriter. The underwriter will apply a more critical analysis to the case before accepting the risk for the carrier, and that analysis will require more data than the business financial supplement provides. Here are just a handful of such scenarios that we frequently encounter – followed by our strategy for maximizing the likelihood of getting the client the desired outcome.

- Startup Company. A new company is often formed based on the talents of one or two uniquely qualified people. In the case of an owner, it’s not unusual for there to be no actual salary to report in the early years of the venture. Even highly talented non-owners are known to accept below-market compensation at a startup in exchange for the opportunity to make much larger sums as the company matures.

- Venture Capital / Private Equity. Both new and existing companies may seek to fuel their growth by exchanging equity for capital raised by managers or private equity funds. Those investments are made, in large part, based on the fund manager’s confidence in the current owner. Sometimes a fund manager will want to use life insurance to hedge against the risk of the owner dying, ideally with the death benefit allowing the fund to exit with the original amount of its investment.

- Unpaid Key Person. A company does not have to be a startup to have a key employee whose value to the company is not reflected in the amount of compensation they earn. This can happen in a closely held family business where a senior generation leader has already acquired more than enough personal wealth and wants to shift income to the next generation. It can also happen when a company is able to compete nationally based on an employee’s unique relationships or talents, but the company’s pay scale is based on the local economy, or when a non-profit is led by a talented executive who could earn much more elsewhere but has a passion for the mission.

When the face amount requested for a key person policy falls outside the industry standard income multiple, success requires additional steps. To secure an underwriter’s offer to issue a policy with the desired face amount, we must address the financial justification challenges the underwriter will face. In our experience, having a plan goes a long way to obtaining successful outcomes, a plan that includes many of the following:

- Engage the right insurance companies.

- Tell the right story.

- Get informal approval prior to formal submission.

- Demonstrate the management team’s experience and expertise.

- Show true value of the employee to the business.

- Explain why the company anticipates success.

- Share forward-looking profitability projections.

Are you a business owner that would be heavily impacted by the loss of a key person? Do you have a plan in place? Our team of planning experts is here to help. Let’s talk.