Irrevocable Life Insurance Trusts

An Irrevocable Life Insurance Trust (ILIT) is a legal arrangement used in estate planning to hold life insurance policies outside of the insured person’s estate, ensuring that the proceeds from the policy are not subject to estate taxes upon the insured’s death. It’s an essential tool for individuals looking to protect and efficiently transfer their wealth to beneficiaries while minimizing potential estate tax liabilities.

The primary purpose of an ILIT is to shield the life insurance policy’s death benefit from being included in the insured’s taxable estate. When someone owns a life insurance policy on their life, the death benefit is typically included in their estate and can be subject to federal and state estate taxes. An ILIT, however, is a separate legal entity, and the policy is owned by the trust, not the insured. As a result, the death benefit can be distributed to the beneficiaries without incurring estate taxes, preserving more of the estate for heirs.

ILITs are important for several reasons:

- Estate Tax Reduction: An ILIT can substantially reduce or eliminate estate taxes on the insurance proceeds, ensuring that heirs receive the full benefit of the policy.

- Creditor Protection: Assets held within the trust may be protected from the insured’s creditors, providing an additional layer of financial security.

- Control: The grantor of the ILIT can specify how the insurance proceeds are distributed to beneficiaries, ensuring that the funds are used for their intended purposes, such as education, mortgage payments, or any other specific needs.

- Privacy: Using an ILIT can keep the details of the insurance policy, including the death benefit and beneficiaries, private since the trust document is not part of public record.

- Avoid Probate: An ILIT allows for the seamless and prompt distribution of life insurance proceeds without going through the probate process, saving time and potential costs.

To establish an ILIT, the grantor (the person creating the trust) irrevocably transfers ownership of a life insurance policy to the trust, names a trustee to manage the trust assets, and designates beneficiaries. The grantor can also make annual gifts to the ILIT to cover premium payments, which can leverage the annual gift tax exclusion.

An ILIT is a powerful tool in estate planning, allowing individuals to protect their assets, reduce estate taxes, and ensure a smooth and tax-efficient transfer of wealth to their loved ones. Risk Resource places careful consideration when designing a life insurance policy for an ILIT and works closely with legal professionals to align each client’s estate planning objectives and circumstances.

Types of Life Insurance for ILITs

The most commonly used life insurance policies for ILITs are typically survivorship (second-to-die) and whole life insurance policies. These policies are chosen for their permanence, cash value growth, and estate tax benefits. Survivorship policies, insuring two lives (usually a married couple), pay the death benefit after the second insured passes away, making them ideal for estate tax planning. Whole life insurance provides a guaranteed death benefit and accumulates cash value over time, making it a stable choice for wealth transfer. Both policies ensure that the policy proceeds are kept outside the taxable estate and can be used to cover potential estate tax liabilities while protecting assets for beneficiaries.

Types of Life Insurance for ILITs

The most commonly used life insurance policies for ILITs are typically survivorship (second-to-die) and whole life insurance policies. These policies are chosen for their permanence, cash value growth, and estate tax benefits. Survivorship policies, insuring two lives (usually a married couple), pay the death benefit after the second insured passes away, making them ideal for estate tax planning. Whole life insurance provides a guaranteed death benefit and accumulates cash value over time, making it a stable choice for wealth transfer. Both policies ensure that the policy proceeds are kept outside the taxable estate and can be used to cover potential estate tax liabilities while protecting assets for beneficiaries.

Estate Liquidity Solutions

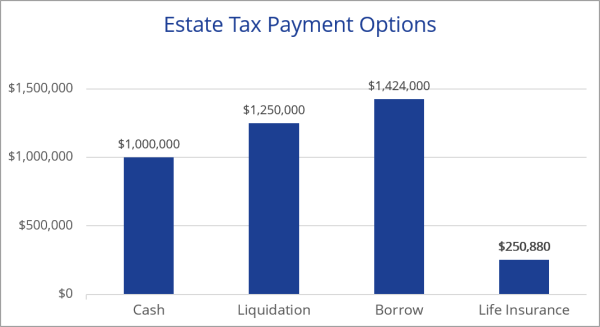

Life insurance can be a tremendous liquidity tool to pay estate taxes within a short period of time. It can also be an effective tax-efficient and tax-advantaged asset. Most life insurance policies are less expensive than other methods to pay estate taxes and can prevent other valuable assets from having to be liquidated.

Cash Option

100%

Dollars

Liquidation Option

Discounts, fees, commissions

Borrow Option

100% +

Interest

Life Insurance

Discounted Dollars

Graph depicts potential costs per million dollars of estate tax. Life insurance insurance figure based of healthy male, age 54.