The Eighth Wonder of the World

November 2018 Newsletter | By: Ian Sachs, CFP®

View on LinkedIn

Albert Einstein

Albert Einstein has been quoted for saying, “Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t… pays it.” Warren Buffett is also well known for praising compound interest as the single most powerful factor behind successful investing.

compound interest refers to the addition of interest to the principal sum of an investment. In other words, it equates to earning interest on interest.

What does this mean for you?

Compound interest comes into play when one thinks about an investment (or loan), especially when it comes to retirement planning. Many of us have assets that compound on a regular basis such as a 401(k) or IRA. This type of interest takes advantage of time, becoming the essence of delayed gratification. All things being equal, the more time something has to compound, the higher the return it will yield at a given date.

Example of Compound Interest

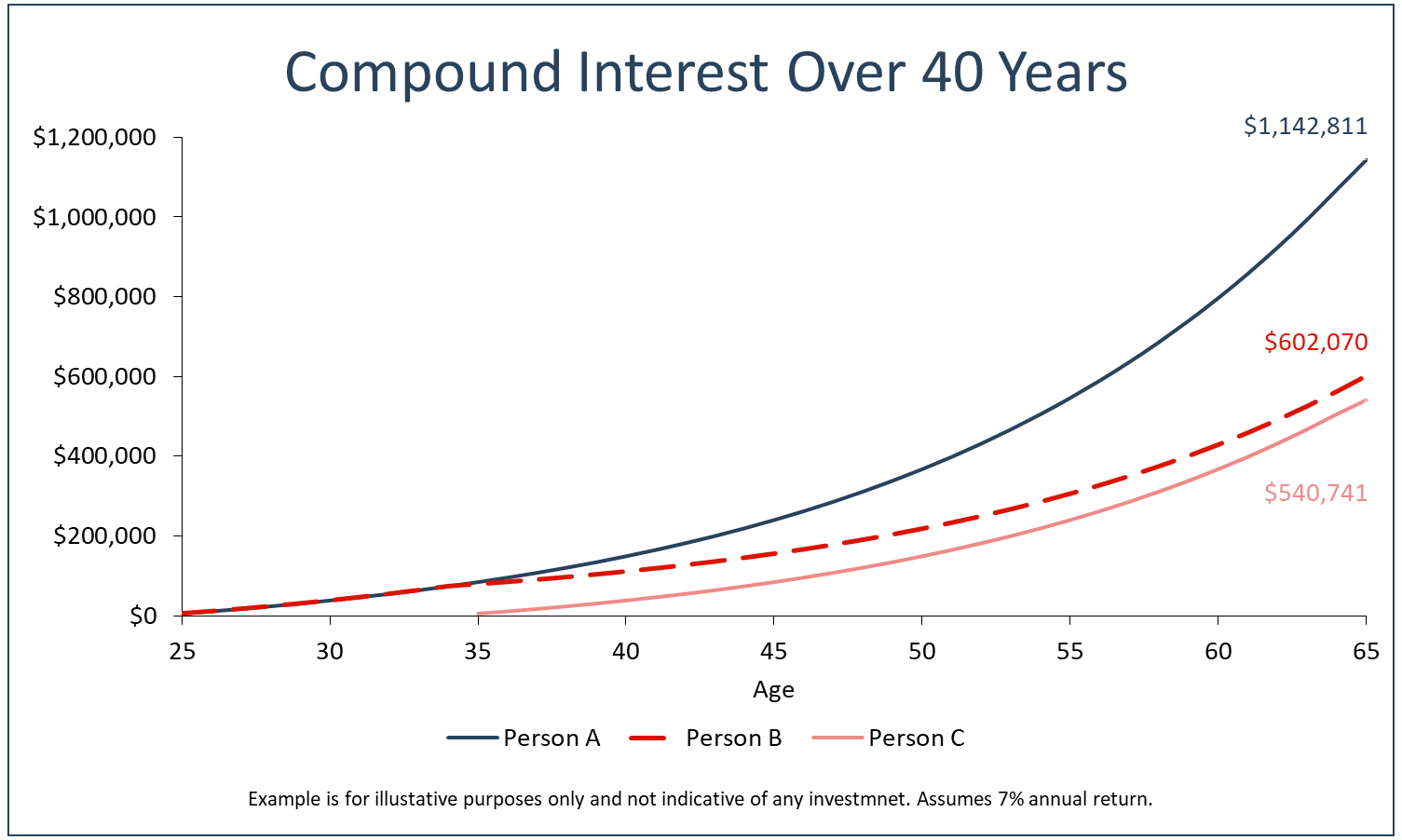

>Let’s assume that there are 3 people who decide that they want to invest $5,000 into a hypothetical wealth accumulation vehicle that produces a consistent rate of return of 7% each year. Each person is 25 years old.

- Person A – Invests for 40 years then stops (total of $200,000)

- Person B – Invests for 10 years then stops (total of $50,000)

- Person C – Waits 10 years then invests for 30 years (total of $150,000)

Person A’s investment will show the highest return, which isn’t surprising because they invested the most money and over the longest period. However, you might be surprised to find out that Person B ends up with more money than Person C even though Person B only invested one third the amount. This is because of compound interest.

Conclusion

There are a handful of popular wealth accumulation vehicles that take advantage of compound interest. One way to get the most out of compound interest is to defer or eliminate taxes, which can be accomplished with Indexed Universal Life Insurance. If you wait to save for retirement, you will miss out on the benefits of compound interest. As they say, slow and steady wins the race.