Insuring Your Economic Value with Term Life Insurance

October 2022 Newsletter | By: Ian Sachs, CFP®, CLU®, ChFC®

View on LinkedIn

We provide advanced life insurance solutions for wealth transfer and business planning. That is our specialty. However, a lot of the time, our clients simply want to protect their families and businesses from the financial impact of a premature death. Unique and sophisticated estate planning needs are not always necessary.

An individual’s ability to earn an income as an intangible family asset is converted into tangible wealth over a period of years. As with any high-value asset, it makes sense to consider insuring against the risk of loss.

106 million adults in America have either no life insurance or inadequate coverage. Only 47% of those households feel that they would be financially secure if the primary wage earner suddenly passed1. Term life insurance is often the most cost-efficient solution for protecting someone’s income earning potential until retirement age.

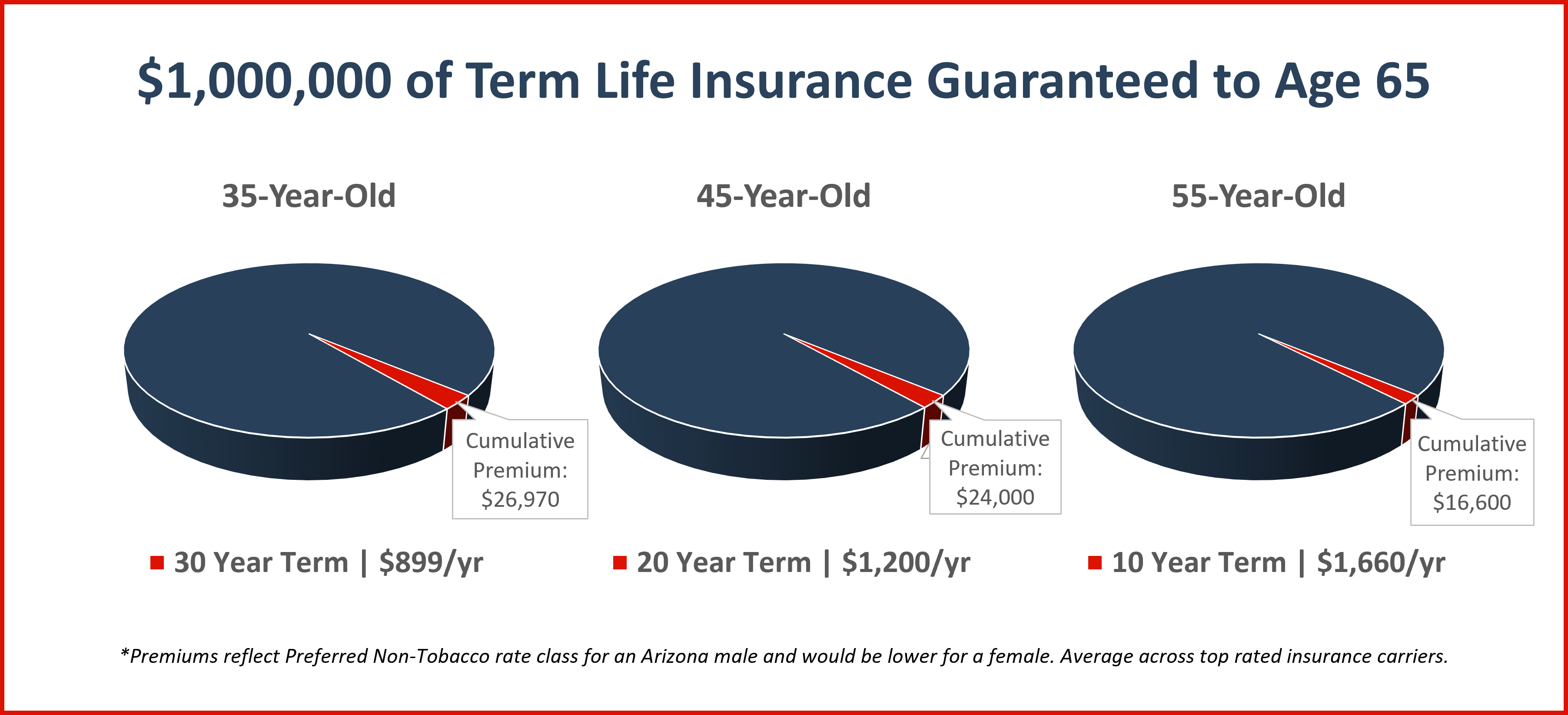

Term life insurance is usually much less expensive than people realize. Examples in the illustration below show the annual and total cost of insuring an adult to a retirement age of 65. At this point, an individual’s net worth will ideally be substantial enough to begin providing an income stream. This is the most straightforward way to utilize life insurance to protect your family and business.

3 Simple Ways to Calculate Your Life Insurance Needs

The following methods are the most common ways to calculate an individual’s life insurance needs to bridge the gap until retirement. More complex considerations such as estate equalization, intergenerational wealth transfer, and estate taxes are outside of the scope provided below.

1. Multiple-of-Income Approach. This method estimates your life insurance needs with the goal of replacing the primary breadwinner’s salary. Industry standards suggest 10-15x your income.

2. Human Life Value Approach. This method is more robust in determining your overall economic value and takes age, occupation, current and future earnings into consideration. It accounts for taxes, assumed interest rates, and inflation. However, it doesn’t account for funeral costs, children’s educational expenses, or other specific future needs, to name a few.

3. Capital Needs Analysis. In addition to replacing salaries, this approach accounts for other sources of income and survivor needs. It factors in funeral expenses, debt and mortgage repayment, education and long-term care expenses, retirement funding, and existing family assets.

There’s no one-size-fits-all with life insurance. To learn more about what your needs might be for your particular situation, give our office a call. We can take you step-by-step through the above methods or move into more advanced calculations as needed.

—

1. 2022 Insurance Barometer Study, conducted by LIMRA