The Retirement Tax Trap

Learn how to utilize a tax-free alternative to your 401(k).

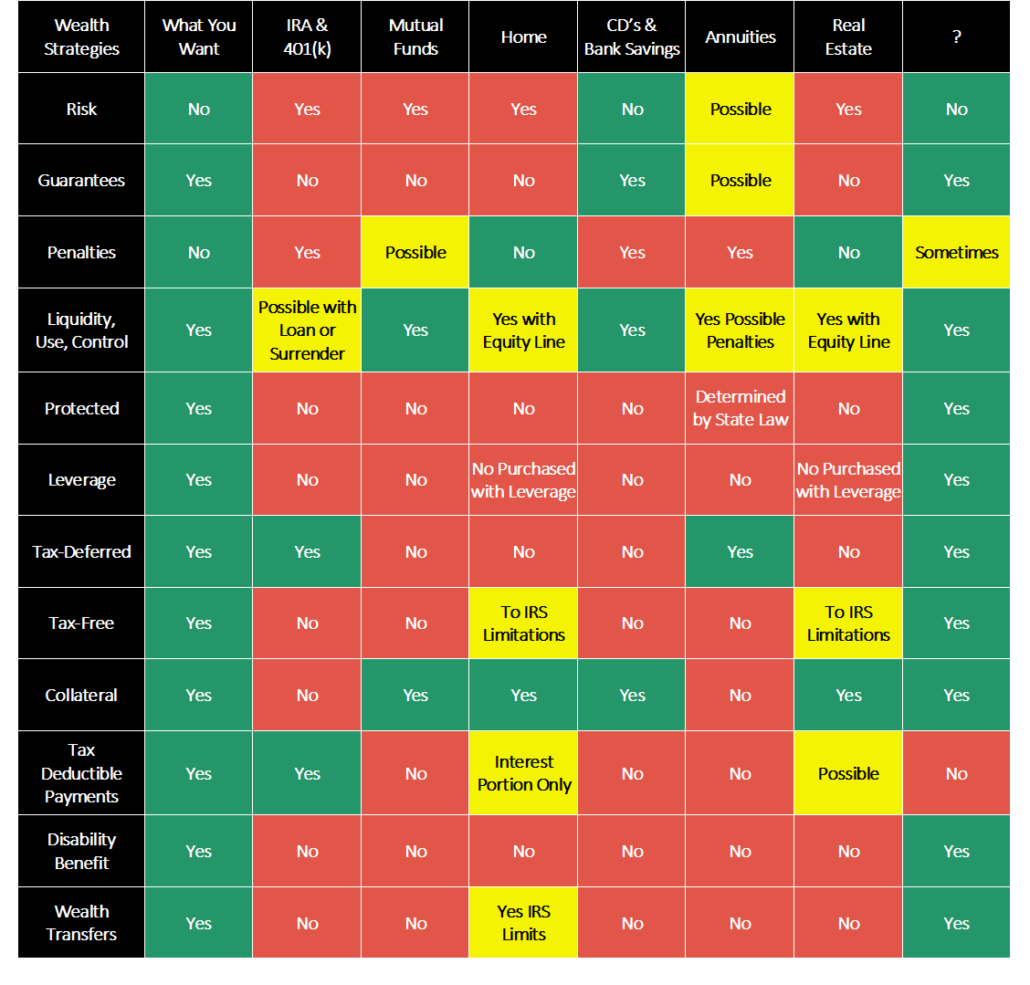

Because tax-deferred financial vehicles require participants to ultimately pay income tax on contributed assets and earned interest, it’s important to consider the overall taxes projected to be paid. If you are interested in creating a Tax-Free Retirement plan, please provide your email or give us a call.

Consumer Guide: How to Escape the Retirement Tax Trap

Free Guide: How to Escape the Retirement Tax Trap

This short guide reveals proven strategies that you can use to build wealth and significantly minimize taxes in the future.

- The strategy that generated $65,000 per year of tax-free income using the wealth-building vehicle. This money can be used towards retirement, college tuition, and much more.

- The four biggest retirement risks that can cost you thousands. One of them will be experienced by 50% of the American population and there is nothing you can do about it, but plan accordingly.

- The unique crediting strategy that captures the gains of the market without ever suffering the downside losses. This follows Warren Buffett’s “two rules to investing” method.

- The #1 tax-minimization retirement vehicle that former comptroller general of the U.S., David Walker, was cited saying that he put as much as you can into this vehicle as the future is unknown.