Disability Insurance

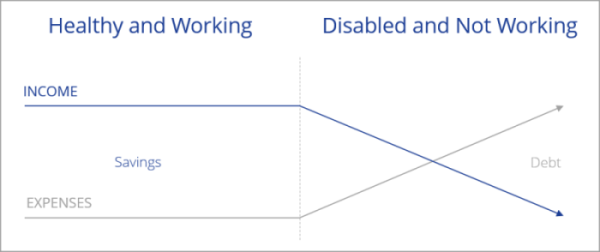

If you need a paycheck, you need disability insurance. There are many components to financial security, but an individual’s ability to work and earn an income is what makes everything else possible. People insure their homes, cars, and personal property, yet they often fail to consider insuring the one thing that makes all of it possible – their income.

How solid is your foundation?

When someone is too sick or hurt to work, the bills don’t stop. Plus, there may be additional expenses for medical treatment or assistance. Many believe the government will support them, but the average amount of time it takes to collect Social Security disability benefits, if you qualify, is over a year. Employer policies are usually taxable, leaving less income to go around. Are you confident your family would make ends meet?

Professionals who have invested years of rigorous education and training to reach their professional zenith, require tailored coverage that comprehensively protects their unique financial interests. Disability insurance is not a one-size-fits-all solution; it demands a deep understanding of their specific needs and financial intricacies.

Attorneys and physicians, for example, often have high earning potentials, making it essential to craft disability insurance policies that can replace a significant portion of their income in the event of a disability that prevents them from practicing their profession. These policies should be meticulously structured to align with their income levels, occupation-specific risks, and future earning potential. As an insurance firm specializing in this niche, we guide our clients through the complexities of disability insurance and ensuring they are adequately protected.

Understanding the nuances of various insurance carriers, policy riders, and contractual terms is vital in helping individuals make informed decisions about their disability coverage.

Critical Illness Insurance

Critical illness insurance is a vital financial safety net designed to provide a lump-sum payment to policyholders upon the diagnosis of a severe medical condition, such as cancer, heart disease, stroke, or organ failure. This coverage is essential because it helps individuals and their families cope with the immense financial burdens associated with serious health issues. When a critical illness strikes, it often leads to substantial medical bills, lost income due to time off work, and additional expenses related to treatments, therapies, and necessary lifestyle adjustments.

Critical illness insurance can be used to cover these costs, ensuring that individuals can focus on their recovery without the added stress of financial instability. It allows policyholders to maintain their standard of living, access specialized medical care, or even seek experimental treatments if necessary. By providing a financial cushion during a challenging time, critical illness insurance not only helps protect an individual’s health but also their financial well-being and peace of mind.